Halal pharmaceutical industry should be better-prepared when growth returns

The Covid-19 pandemic has severely disrupted the global economy as well as the Islamic economy.

Some of the top exporting countries in the world have been adversely affected by the Covid-19 pandemic. Manufacturing, production, and logistics have been disrupted, affecting the global supply chain.

“There was a lot of uncertainty earlier, but now that the signs of the vaccines are much clearer, our confidence in the sector and industry is bouncing back,” Dinar Standard CEO and Managing Director Rafi-uddin Shikoh told The Health.

“Our projection of the growth returning towards the end of 2021 is further strengthened.”

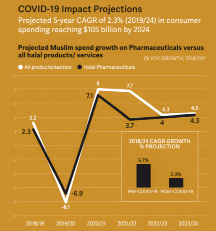

Based on the post-Covid projection, recovery to 2019 levels is expected in 2021. Muslim consumer spending in the pharmaceuticals sector could increase at a five-year Compound Annual Growth Rate (CAGR) of 2.3 per cent to reach US$105 billion by 2024.

“Even though the percentage indicates growth, it is bringing it back from the losses we have suffered. So, from an aggregate value of the industry, the industry is going to see a loss, compared to the pre-Covid projection, which was at 5.7 per cent CAGR growth.”

The global Muslim consumer spending on halal pharmaceuticals saw an increase by 2.3 per cent from US$92 billion in 2018 to US$94 billion in 2019, according to the ‘State of the Global Islamic Economy (SGIE) Report 2020/21: Thriving in Uncertainty’.

In 2020, however, the Muslim spending saw a drop by 6.9 per cent, reaching US$87 billion. Perseverance is the key now. How can the pharmaceutical industry persevere, to hold on and be better prepared as the growth returns?

“First and foremost, the focus has to be on surviving until you get back to a demand cycle that was there before.

“It would help if you looked to innovate and address some of these opportunities that are coming up,” he said

Moving towards digital transformation

Within the pandemic disruptions, the SGIE report identified several developments and opportunities for halal pharmaceuticals.

While there was a general drop in demand, the preventative care segment saw a surge in demand for nutritional supplements and vitamins because of the renewed focus on immunity and good health.

There was also a shift in the global supply chain as four of the top five exporters for halal products were heavily-impacted by Covid-19.

“Many Organisation of Islamic Cooperation (OIC) importing countries are looking for an alternative for to the supply chain. And so, there is growth at the government level to invest in local manufacturing or alternative sources for supplies from the regional markets, especially Indonesia and Saudi Arabia.

“Another area is telemedicine. As we see, the industry is moving towards digital transformation, digital distribution, the digital aspect of retail, and new ways to reach the customers.

“It includes even the doctors or the clinics, who are the first point of distribution for pharmaceutical products, engaging with customers through digital platforms or further supporting them through digital platforms.”

Rafi-uddin also highlighted that with touchless and contactless being key areas, going digital was vital for the medical service providers as well.

There is also growth in sub-segments, such as online retail and distributions.

“In pharmaceuticals, we see the growth similar to how online groceries have taken up and every aspect of digital delivery of services has taken up.”

Based on the SGIE report country indicator, Malaysia has a robust pharmaceutical or halal pharmaceuticals ecosystem.

“We have a country benchmarking, and Malaysia, in pharmaceuticals and cosmetics as an aggregate indicator, continues to rank number one.”

Rafi-uddin credits it to Malaysia’s healthy and high quality regulatory and compliance systems around halal pharmaceuticals, as well as a beneficial and far-reaching awareness across the halal pharmaceutical industry.

Global supply chain disruption an opportunity

He, however, noted when it came to trade and export, Malaysia was not in the top five of halal pharmaceutical exports, nor was it in a consumption size point.

“Malaysia ranks 19th in the world in exports of halal products, food, pharmaceuticals and cosmetics, which is only 1.7 per cent of the US$255 billion of worldwide exports.

“So, for Malaysia and the pharmaceutical space, the disruption in the global supply chain is an opportunity area,” he said.

He highlighted that apart from attracting Foreign Direct Investment (FDI) into Malaysia, another opportunity for Malaysian companies would be how Malaysia could take its expertise to markets like Indonesia and Saudi Arabia. They are looking for partners to do their domestic manufacturing there.

“There are lots of opportunities for pharmaceutical manufacturers from Malaysia. The country has strong technical expertise which it can bring to other OIC countries or Islamic markets.”

The SGIE report was produced by DinarStandard, a US-based research and advisory firm, and supported by the Dubai Islamic Economy Development Center.

Since 2013, the report, now in its eighth edition, has been providing information on seven key sectors whose core products and services are affected by Islamic law and which represent a global consumption market. — The Health