A well-designed policy framework can ensure the long-term sustainability of the solar PV industry and in turn, spawn a green economy which by now is necessary as nations heal from a year-long coronavirus pandemic

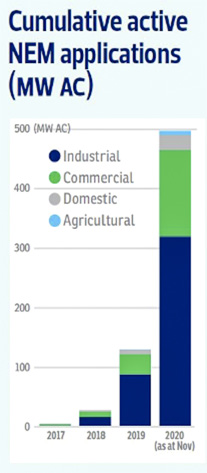

On Nov 27, 2020, the 500MW of NEM quota, initially announced in Budget 2017 on Oct 5, 2016, was finally fully subscribed.

The original nett energy metering (NEM) scheme began on Nov 1, 2016, and the quota was intended to last until the end of 2020. Although from 2017-2018, the growth of NEM was low, a policy change which took effect on Jan 1, 2019, helped the uptake of the NEM.

The policy change, dubbed NEM2.0, essentially changed surplus solar electricity’s compensation rate from displaced cost to a 1-on-1 offset.

This change, coupled with the existing government incentives such as the Green Investment Tax Allowances (GITA) and the Green Technology Financing Scheme (GTFS), helped improve the returns for companies that invested in solar photovoltaic (PV) for a rooftop.

Last year turned out to be a year of surprises because, despite the Covid-19 pandemic struggle, the solar PV industry grew spectacularly. Suffice to say that Malaysia is one of the countries within this region with solar PV policies that helped to spawn a green economic recovery.

Business owners post the MCO partial lockdown from March to May realised their solar investment under the NEM was making financial sense as any excess solar electricity was allowed to roll over for 24 months under a 1-on-1 basis.

The excitement for LSS@MEnTARI did not hamper the take up for NEM2.0 either. As can be seen from the chart from SEDA, the take-up rate in 2020 was overwhelming.

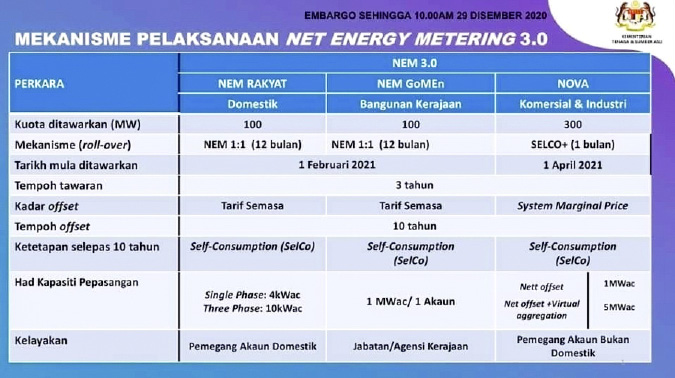

The quota for NEM2.0 was finished a month before the year-end deadline. This created a new demand. On Dec 29, 2020, the Ministry of Energy & Natural Resources (KeTSA) announced the much-anticipated NEM3.0. The table below shows the salient features of NEM3.0.

Conclusion

The government should be lauded for rapid response in formulating NEM 3.0 within a month after the 500MW quota for NEM2.0 was finished.

The solar industry for this Covid-19 period has helped to boost green economic growth and employment. In November 2020, the International Energy Agency (IEA) declared that solar energy is the cheapest form of energy.

In Malaysia, we do have abundant solar technical potential. Despite this low cost of solar energy, Dr Fatih Birol, Executive Director of the IEA, emphasised the roles of policies that will continue to remain critical in driving a vibrant and robust solar PV market.

The NEM3.0 has demonstrated innovation, but further restrictions imposed in the spirit of spreading the pie over a bigger pool of recipients. Moving forward, perhaps there may not be a need for a quota system anymore, thereby not creating the concern of a boom-and-bust solar PV industry.

Instead, a well-designed policy framework can ensure the long-term sustainability of the solar PV industry and spawn a green economy necessary as nations heal from a year-long coronavirus pandemic. — @green

Review of NEM2.0 & NEM3.0

| Feature | NEM2.0 | NEM3.0 | Implication |

| Quota Allocation | 50MW for residential 450MW for others (Commercial, industrial & agriculture) |

100MW for residential 100MW for Gov’t 300MW for commercial & industrial (C&I) |

The demand for rooftop solar PV based on NEM2.0 showed that the highest order came from C&I (~90 per cent). The 300MW allocation for C&I sector under NEM3.0 is now reducing the distribution to only 60 per cent. |

| Residential: Single-phase 3 phase |

12kWac 72kWac |

4kWac 10kWac |

Under NEM3.0, quota can be spread across more residential applicants due to the reduced cap and increased allocation. Still, each applicant cannot maximise rooftop space to take advantage of economies of scale and increase electricity savings. |

| C&I | No cap but have to comply with technical limits of NEM guidelines | 1MWac (Nett Offset) 5MWac (Nett Offset with virtual aggregation) |

The new cap for C&I under NEM3.0 poses a double constraint for premises which meet the technical guidelines (at least of existing NEM2.0) and can go beyond the 1MWac or 5MWac. Again, this limitation will not allow the business owner to maximise rooftop space to take advantage of economies of scale, reduce their carbon footprint & increase electricity savings. In a world where the nett-zero commitment is demanded by most developed economies, these companies’ need (with exposure to these markets) will require them to reduce as much carbon footprint especially if it also makes economic sense. On the positive side is introducing an innovative concept of virtual aggregation (or virtual NEM) which allows solar energy generated offsite to be shared by 3 accounts under the same business operator. This effort is lauded as the electricity demand for each building differs and buildings with large roof and low demand can optimise their roof space with solar PV installations through energy sharing. |

| Compensation Rate for surplus electricity for C&I & Rollover | Compensation based on 1-on-1 | Compensation based on Systems Marginal Price (SMP) | The SMP is not a concept well known to all. Some awareness is needed among the business community, and the concern here is that, at this juncture, the SMP is much lower than the displaced cost paid under the original NEM or NEM1.0. Therefore, it remains to be seen how this change in compensation rate affects the decision to invest in solar PV under the NEM3.0. As an alternative, the government can consider opening the grid for third party access and allow excess solar electricity to be traded instead. This will provide opportunities for consumers to buy solar electricity from prosumers (those with solar PV rooftops) at a competitive rate with the regulated tariffs. |

| Rollover of 24 months | Rollover of 1 month | Under normal situation, business operations seldom stop over a prolonged period. Hence, a rollover of one month may deem to be reasonable. However, taking the cue from 2020, the Covid-19 pandemic has forced business closures for several months. It is times like this when extending the rollover beyond one month will help preserve investors’ cashflow from eroding, especially when normal business operations are not allowed. | |

| After 10 years, NEM3.0 will fall under SELCO for all categories. | Under SELCO, excess solar electricity will not be allowed for export. This differs with NEM, which helps excess solar electricity to be export (within technical compliances). Because of this fundamental difference, the solar PV system for SELCO is designed differently from NEM. For SELCO, the solar PV system is designed, so there is least opportunity for solar electricity to be exported, whereas this constraint is not in NEM. Businesses with seven days operations will benefit from SELCO as the chances of export are least compared to companies with only five days of operation. Hence, a switch of NEM to SELCO after 10 years may require energy storage to be in place to store the excess electricity which otherwise will not benefit the owners. Again, as with the suggestion above, after 10 years, the grid should be opened for third party access and hence, allow excess solar electricity to be traded. Enabling solar electricity trading at the distribution level can help optimise the local grid usage, so losses at the transmission grid are reduced and allow both prosumers and consumers to trade solar electricity at prices agreeable to both parties. |

||